"How Much Does Each US Wealth Bracket Pay In Income Taxes?"

Its an interesting article due how it doesn't show you which brackets are tied to which income levels. I'll show that equivalence below.

Heres the Article.

<snip>

The top 1% of U.S. earners paid 40% of federal income taxes in 2022, based on the latest available data.

This share has risen from 33.2% in 2001.

Meanwhile, the share paid by the bottom 50% of earners fell from 4.9% to 3% over the same period—likely reflecting the growing concentration of wealth at the top, which has boosted tax contributions from high-income individuals.

This graphic, via Visual Capitalist's Dorothy Neufeld, shows federal income tax revenue by wealth bracket, based on analysis of IRS data from the Tax Foundation.

Breaking Down America’s Income Tax Revenue

Below, we show the share of total federal income taxes paid by wealth tier in 2022:

Americans earning over $663,000, considered the top 1%, paid $854.5 billion in income taxes, the highest share overall.

The average income tax rate for this tier was 26.1%, across more than 1.5 million income tax returns in 2022. Individuals in this bracket paid $561,523, on average, in their income tax filings.

For those falling in the top 5% to 1% of all U.S. earners, income tax revenue amounted to $448.6 billion, the second-highest share. Taxpayers falling into this bracket earned between $261,591 and $663,164 and paid 23.1% on average in income tax.

Meanwhile, the bottom half of earners funded the smallest share of total income tax revenue, with an average income tax rate of 3.7%. These represent earners of $50,339 or less, spanning across 76.9 million American taxpayers.

To learn more about this topic from a global perspective, check out this graphic on top marginal income tax rates around the world.

<end snip>

Original URL here.

So you can see there are 6 tax brackets called out in the above article but they don’t tell you what incomes put you in each of the 6 defined.

Additionally whoever edited the Original article to repost it at Zerohedge removed this caveat for the values which shows that the top 1% didn’t pay more than the bottom 50% as it excluded PAYROLL TAXES from being part of the analysis.

“Overall, the bottom 50% of earners contributed 3% of total income taxes paid. However, the data does not include payroll taxes which make up a higher share of paid taxes relative to their income than higher income brackets.”

So some wealthy asshat massaged the data, left out the caveats and then published so they could pretend the wealthy pay the lions share of taxes which is a LIE.

The original article as published is here.

They do not publish the actual tax sums paid INCLUDING PAYROLL TAXES or their LIE would collapse.

Per the tax code there are actually 7 tax brackets for varied earned income levels.

<snip>

Tax brackets 2024: What to know for taxes due in 2025

You may be asking yourself, “What tax bracket am I in?” The federal tax brackets can shift slightly each tax year due to inflation adjustments, so you have to reference the year in which you review the income tax brackets. Here we outline the 2024 tax brackets and corresponding 2024 tax rates.

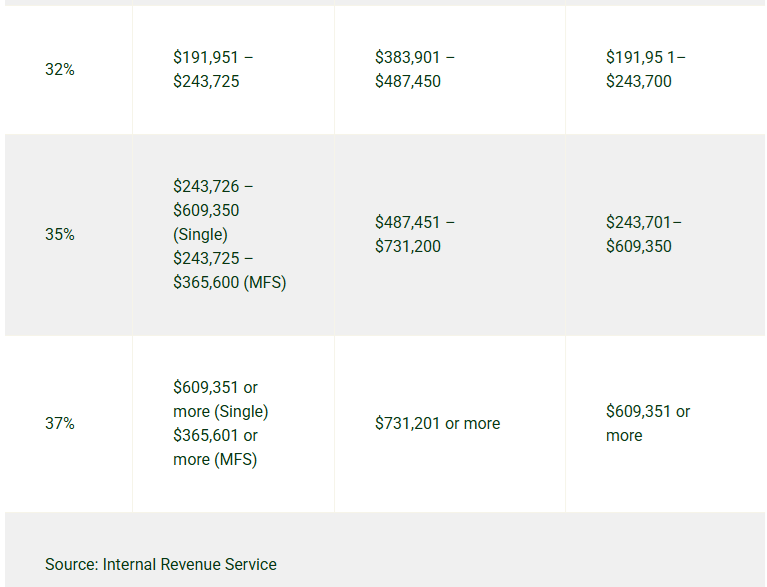

There are seven tax rates for 2024: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

For each tax bracket, the second number is the maximum amount for that tax rate and the next tax rate starts one dollar above it. For instance, the 10% rate for a single filer applies to taxable income up to $11,600 while the 12% rate starts at $11,601.

<end snip>

Original URL here.

It looks like we can equate the top 1% income to the highest tax bracket of 37%.

5%-1% then would be the 35% bracket.

10%-5% then would be the 32% bracket.

25%-10% then would be the 24% bracket.

50%-25% then would be the 22% tax bracket.

100%-50% then would be the bottom two brackets at 12% and 10% respectively.

So this then begs the question of How many Americans are in each Tax bracket?

Source for graphic above is here. (its from 2013, didn’t manage to locate a more current depiction.)

As you can see the top four tax rates have about 7-8 million Americans in them.

I’m not sure why theres a 0% bracket listed, unless those are just people who don’t work but then file their taxes for their annual standard deduction to pay them out somehow.

Otherwise how do 36 million americans have a 0% tax bracket?

Per the usdebtclock.org there are about 112 million americans that are employed, thus paying Taxes.

The bottom ~93 million pay the majority of Taxes.

So lets play with the numbers so we can get an idea of how payroll taxes might play into this review.

Lets say the top 50% pay 300k per individual per year in taxes, assuming about a 30% realized tax rate. We’ll use the 8 million figure times the 300k to get that sum. 8,000,000 * 300,000 = 2,400,000,000,000 or 4 trillion dollars.

Now lets take the bottom 50% and say they pay 20k per individual per year in taxes. We’ll use the 93 million figure for this number of individuals. 93,000,000 * 20,000 = 1,860,000,000,000 or 1.86 trillion dollars. If we halve the 20k to 10k then its half that total at about 930 billion.

As one can see, the ACTUAL numbers matter and greatly affect the resulting perception developed.

One needs to realize that if one makes 150K per year filing single then they are taxed at 24% of their total income, and 24% of 150k is 36,000 dollars.

If ones making 650k per year filing single then they are in the 37% tax bracket and 37% of 650k is 240,500 dollars.

What isn’t accounted for is the remaining funds which the High paid people are left with to Live their Life compared to the sums left to the person in the 24% tax bracket to live their lives.

The person making 150k is left with 114,000 dollars to pay for their expenses during that year.

The person making 650k is left with 409,500 dollars to pay for their expenses during that same year.

The unfairness in the taxation rates is then real easy to see when looked at from this angle.

The person making 650k, if they’re not focused on status and position, can pay off a house in a few years where the person making 150k will take 15 years or the full 30 years to pay off the same priced house of 400k.

The Taxation question needs to be looked at from the Consumers standpoint. And the aim should be to leave the consumers with roughly the same sums to spend for their annual expenses. The reason it isn’t looked at from this view is because the wealthy feel they need million dollar homes in multiple locations along with private jets and multiple expensive cars and this all is somehow justified by the value they bring, when in reality the only value such people bring is that they OBEY AND COLLUDE to keep their funds in their Groups and prevent such from getting to the REST of the people who labor and do Not get paid ridiculous sums for their work.

By the way this shows the idea of equity to be a crock of shite, the wealthy always have the funds to cover their expenses while they who work a 40 hour week for 40 years of their life see times where they have a little more funds to spend versus being in debt across the board when the context is shifted to raise expenses across the board.

The last 4-5 years of the scamdemic and all thats gone on has acted to raise expenses for everyone who lives paycheck to paycheck. This is aimed at forcing the people in the middle class to sell their current assets and buy things that are cheaper which reduces their standard of living as intended, while the corrupt and criminal fed gov gives taxes from tax payers to illegals to fund their incursion into the USA and they still expect Tax payers to just bend over and foot the bill.

The only tax payers who do that are the ones they overpay so ridiculously that they always have the funds to feed back into the criminal apparatus that was setup to make them wealthy in the first place.

Alot like how USAID gave tax payer funds to all sorts of unaccountable groups internationally and nationally and those groups were required to give donations back to the clowns in the fed gov that enabled those handouts in the first place.

Instead of Accountability we get articles claiming that the laborers being stolen from are paying less than their fair share of taxes already, which is a LIE, and they pretend that this entitles those tax payers to less due them not being part of the inbred sold out Owners Club aka the Uniparty in the FED GOV that is now expanding into STATE GOVS where the people seated work to realize their own benefits AGAINST the will of the people in their State.

Without Accountability there is ZERO Authority.

Until Accountability is produced and people are prosecuted for these willful criminal actions, Nobody should pay any FED GOV taxes.

By Law or by Blood, there will be an Accounting.

Accountability is the REVOLUTION.